Fuelled by additional USD shorts, EUR/USD climbed to highs at 1.1389 Wednesday, levels not seen since early March. Leaving 1.14 unchallenged, buyers hit the ropes as the pair dived to lows at 1.1342. 1.13 remains a standout support on the H4 timeframe, sharing space with Quasimodo support at 1.1268 and trend line support, extended from the low 1.0727.

Category: Recent

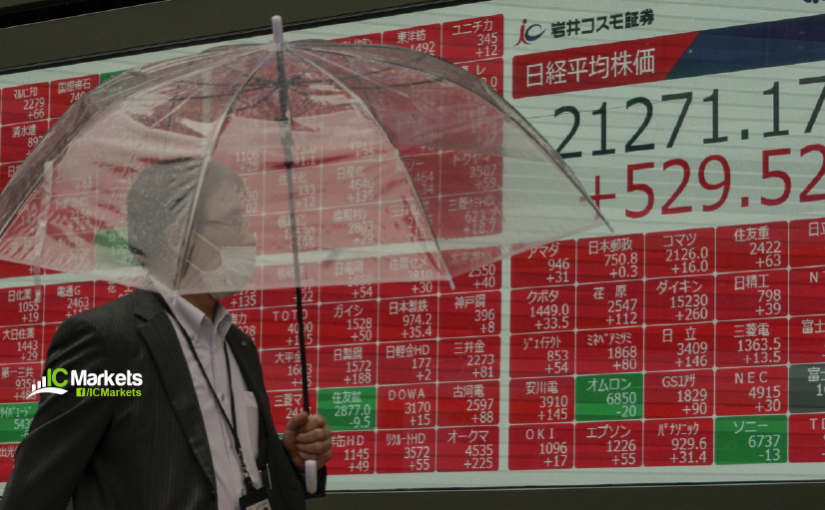

Wednesday 10th June: Asian markets mixed as Chinese inflation misses expectations; Fed policy awaited today

Global Markets: Asian Stock Markets : Nikkei up 0.15%, Shanghai Composite down 0.42%, Hang Seng up 0.22%, ASX up 0.06% Commodities : Gold at $1725.45 (+0.21%), Silver at $17.85 (+0.30%), Brent Oil at $40.41 (-1.87%), WTI Oil at $38.05 (-2.29%) Rates : US 10-year yield at 0.804, UK 10-year yield at 0.315, Germany 10-year yield … Continue reading Wednesday 10th June: Asian markets mixed as Chinese inflation misses expectations; Fed policy awaited today

Wednesday 10th June: FOMC in Focus

EUR/USD, according to the H4 timeframe, dipped to 1.1241 yesterday, leaving support at 1.1221 unchallenged, before turning to reclaim 1.13+ status to shake hands with recently formed Quasimodo resistance at 1.1362.

Tuesday 9th June: Asian markets gain as S&P 500 wipes YTD losses

Global Markets: Asian Stock Markets : Nikkei down 0.38%, Shanghai Composite up 0.62%, Hang Seng up 1.86%, ASX up 2.44% Commodities : Gold at $1702.60 (-0.15%), Silver at $17.84 (-0.31%), Brent Oil at $40.93 (+0.32%), WTI Oil at $38.42 (+0.60%) Rates : US 10-year yield at 0.839, UK 10-year yield at 0.319, Germany 10-year yield … Continue reading Tuesday 9th June: Asian markets gain as S&P 500 wipes YTD losses

Tuesday 9th June: Technical Outlook and Review

EUR/USD left Monday muted, glued to the underside of the 1.13 handle on the H4 timeframe, ranging between 1.1319/1.1268. Downside support from here, therefore, remains at 1.1221 (prior Quasimodo resistance), closely followed by the 1.12 handle and trend line support, taken from the low 1.0727.