From institutional investors hedging portfolio risk to independent retail speculation, the foreign exchange (FX) market caters to a diverse community.

Dependent on financial circumstances, time constraints and trading experience, starting capital varies for retail traders.

Money and its emotional connection

People interpret money in different ways. It draws on several emotions, including power, security, freedom, happiness, greed and fear. Rational people can lose the ability to function when overcome with emotion. Therefore, it’s important you’re comfortable with the account’s balance and, ultimately, the risk profile.

Trading losses and being wrong are the catalysts behind most trading errors. Revenge trading, for example (when a trader attempts to win back recent losses), is driven by fear and frustration and can have devastating consequences. This can exacerbate losses and create a malicious spiral in which the trader’s account becomes reckless.

Successful traders are cognisant of this hazard. A loss, if the trading strategy’s rules are adhered to, is simply that – a loss. They know losing trades are an inevitable expense, akin to rent or returned goods, if you managed a shop.

Experience

One of the most valuable resources a forex trader can draw on is experience. Without experience, recognising opportunity and efficiently managing risk is a challenge.

One of the toughest things to master in trading (and in life) is patience, and this only comes with experience operating in the markets. While it may seem a small feat, having the ability to wait until price hits your entry line is an accomplishment in and of itself. Additionally, knowing when best to remain flat in the market is another skill, only mastered with experience.

Charlie Munger said it best, ‘The big money is not made in the buying and selling… but in the waiting’.

The level of experience determines account size. Obviously, the more experience one has, the more confident they generally are.

Lot sizes

Understanding trading lot sizes help determine which trading style to adopt and, ultimately, the required amount to trade.

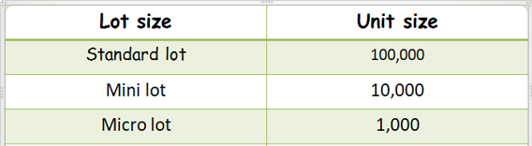

FX brokers have made it easier to trade with smaller accounts. At IC Markets, we offer standard lots, mini lots and micro lots.

Each lot size requires a different account size to trade.

100,000 units of the base currency is known as a standard lot with a value of approximately $10 each point move, though this depends on the currency pair you are trading. A trader risking 20 points equates to $200 risk, meaning an account of at least $10,000 is needed, assuming a standard risk of 2%.

10,000 units of the base currency is known as a mini lot, representing a value of approximately $1 each point move. Although automatic, this is accomplished by subdividing a standard lot into ten. Opening a trade with a 20-point stop in this case equates to $20 risk. This allows an account of $1,000, assuming a risk of 2%.

1,000 units of the base currency denotes a micro lot with an approximate value of $0.10 each point move. This is done by subdividing a mini lot into ten – a 20-point stop results in $2 risk. In this case, a $100 account is sufficient, representing a 2% risk.

Realistic expectations

Experienced traders often promote the use of demo trading. Using simulated funds may not trigger the emotional connection as seen in live markets, but it is a good start.

A demo trading account allows you to experience the live markets without risking money. It also allows traders to familiarise themselves with the platform’s functions and ‘forward test’ strategies. Following consistency in a demo environment, traders will then be confident to switch to a micro lot account. With IC Markets you can open an account with as little as $200.

The idea behind switching to a micro account, and not directly to a mini or standard account, is to build confidence and experience and to help familiarise yourself with an increasing risk profile. Once you’re consistent building a micro lot account, switching things to a mini lot account is a reasonably easy transition.

Consistency may mean 3, 6 or 12 months of account growth. An alternative could be a percentage gain, such as 20% to qualify moving account sizes. This will be trader dependent.

Trading for months on a demo account, or a micro account, may be too slow for some newer traders.

Traders, however, are urged to put in the work; trading can truly be a life-changing endeavour most only dream of.

- Newer, inexperienced, traders should begin with demo accounts.

- 90% of the consistent traders we’ve interviewed over the years built their accounts slowly and methodically.

- Trading is not a get-rich-quick-scheme.

- Trading is a serious business, and should always be treated as such.